Years from now, reps will be scratching their heads when someone tries to explain the differences between inside sales and outside sales, and even inbound or outbound sales.

The lines are blurring. Today you see:

- reps that never have to leave their house

- AEs blocking time for cold calling

- prospects who know the ins and outs of your product before the first qualification call

With the risk of sounding cliché, it’s because the way buyers buy has changed.

They don’t need to meet in person, they don’t want to get routed between four different reps, and they won’t commit to a company-wide rollout before testing the product.

As a result, sales motions are evolving, especially in B2B SaaS.

Let’s dig into some of the best examples to learn what’s worked for top companies and help you win more deals.

What is a sales motion?

A sales motion is the path a sales team takes to reach prospects, move them through the sales cycle, and close deals. Employing a sales motion is a mix of methodology and tactics.

Popular sales motions include:

- Outbound sales

- Field or outside sales

- Product-led sales

- Channel sales

Companies typically have more than one sales motion in place at once.

A sales motion is a subset of a company’s overall go-to-market (GTM) strategy, which is a plan that outlines all of the ways you bring your product to customers.

That plan also includes processes for conducting research, developing the product, building marketing campaigns, and handling customer support.

Sales motions vs. sales plays

A sales play is a tactic for a specific scenario or customer type, nested inside of a sales motion.

For example, a sales play could be a follow-up sequence for re-engaging with cold leads. The sales motion still outlines which reps will conduct the outreach, what tools will get used in the process, and how success will be measured.

Sales motion vs. sales methodology

Most sales leaders and CROs here are probably familiar with MEDDIC, the Sandler Selling System, and the Challenger Sales Method.

These are sales methodologies, or frameworks and principles for how reps should sell.

Sales motions put these principles into action by outlining the specific actions that reps should implement in actual customer interactions.

If you train your reps on the SPICED methodology, they’ll have a structured framework for navigating the prospect’s situation, pain, impact, critical event, and decision criteria.

But they’ll still need help identifying which customers to go after, what tools to use, and how they should approach the pricing conversation. That’s what the sales motion provides.

Real-world examples of sales motions

Theories don’t close deals. Let’s look at a few real sales motions in action.

Enterprise and outside sales

Outside sales, or field sales, is making a comeback. But it doesn’t look the same as it used to.

Now it’s adjacent to enterprise sales, where deal sizes are larger, sales cycles are longer, and travel costs are justified.

Reps still communicate with prospects at home through phone calls and emails, but they solidify connections and find new opportunities through customer visits and event meetups.

The startup I currently work for, Beekeeper, is a great example. We sell to HR buyers at frontline companies, often in the mid-market and enterprise space. These are complex organizations with multiple decision-makers who usually need help with implementation.

The product doesn’t sell itself, so we invite prospects to events to hear from similar customers and personas. Most of our leadership is based in Zurich, yet they make it a mission to travel to customer sites across the globe to help seal deals. We call it the “executive visits” program.

And every sales rep acts as a solution-selling consultant.

Instead of walking through a standard product demo, reps customize demo environments to each prospect based on their use case and share examples of how users will engage with the product. They’re also prepared to talk about product roadmap or implementation timelines.

Once the contract is signed, dedicated onboarding specialists, CSMs, and AMs show up onsite to help new customers activate their end-users. This includes everything from hosting contests to suggesting new workflows that admins can build in the product.

Land and expand

Get new logos in the door, then we can sell them more.

The land and expand sales motion is about securing a small win to open larger expansion opportunities within the account.

Landing the deal requires speed and precision.

Zeeshan Yoonas, COO of WorkOS and ex-CRO of Netlify says it best:

“The sooner you can get to dollar one, the less friction you will have in pursuing a larger footprint within an account”.

It’s similar to a freemium pricing strategy, where you generate a higher conversion rate by removing any friction to getting started. Once the buyer is ingrained in the product, then it’s much easier to sell them on a premium version.

To stick the landing, reps need to be trained to pinpoint one specific problem and use case. Then they map out the essential decision makers and influencers to win that first contract.

After landing the account, it gets transitioned to account managers. These reps are the experts at navigating across the organization to find upsell and cross-sell opportunities.

At Chili Piper, we’d start by getting our main buyer, typically a Head of Growth or Marketing, to purchase our flagship product.

The entire sales motion was geared towards winning new logos by sticking to a singular problem. For our prospects, that problem was not being able to convert precious inbound leads into qualified demos.

After the contract was signed, reps would search for revenue expansion opportunities by exploring additional use cases. They’d get in front of Sales Management, RevOps, Customer Success, and even Finance teams to show how our product could help them create a better buyer experience.

Since we were already a preferred vendor, it was easy to advocate for additional licenses and SKUs.

Product-led sales

Product-led growth (PLG) brings in users at low acquisition costs but eventually caps out on revenue potential.

That’s because the user and buyer aren’t always the same person.

As Sarah Wang and David George from a16z explain:

“There’s a limit to the users who want to or are able to discover, use, and pay for it on their own.”

In other words, a single user can’t fork over $500k upfront for software without talking to other humans.

On top of that, users can get stuck in the product and need support to get closer to (1) unlocking value and (2) making a purchase.

Enter product-led sales.

Jesus Requena, former Head of Growth Marketing at Figma, defines it as, “the motion that starts with users finding value in the product, then sales reaching out to the right accounts to educate them that there is a better product tier for them.”

Figma is a poster child for product-led sales, with over four million users, 100% YoY growth from $200M to $400M ARR, and 150% net dollar retention (NDR)!

How did they do it? Kyle Poyar shared their entire playbook.

First, product, marketing, sales, and ops worked together to understand what product behavior and metrics correlate with an upgrade.

If a user takes at least two key actions that signal buying intent, they’re marked as a product-qualified lead (PQL). Automation flags the account to the sales team as one that is likely to upgrade.

Then the product marketing team provides messaging tailored to specific pain points so reps can reach out at the right time with the right message.

Channel sales

Atlassian, the company behind Jira and Confluence, is credited with having one the strongest bottoms-up motions in history.

What most people don’t know is they leveraged channel sales to land some of their largest accounts. Last year, they reached almost $3 billion in ARR, with channel sales in Q2 2022 growing 130% YoY.

Who better to explain channel sales than Cameron Deatsch, the CRO of Atlassian?

A channel sales motion is when you, “cultivate an ecosystem of partnerships around your company that acts as an extension of your in-house teams. These partners help you market, sell, integrate, and extend your products”.

This motion helps you tap into new markets, handle complex implementations, and complement existing use cases. For example, Atlassian used channel partnerships to build their top-down sales motion.

Jay Simons, former President at Atlassian, shares how channel partners found ways to “expand in enterprises, where the early sale of our products was complemented with a real value add — consulting and services.”

Still, many channel sales motions fail or go stagnant due to poor channel sales enablement. They require patience and careful planning but have the potential to be your greatest source of revenue.

Which factors impact your sales motion(s)?

What do all of the success stories above have in common?

Each company grounded their sales motions to the realities of their business. As sales leaders, it’s important to prioritize what makes the most sense based on your customers, products, and processes.

Here are some factors that will help you decide which sales motions to pursue.

1. Average contract value (ACV)

High ACV deals often come with larger buying committees and more scrutiny.

You’re not just competing with other software companies, you’re fighting against the status quo. This is especially difficult when buyers are 17% less likely to purchase from SaaS companies compared to last year.

For high-ACV deals, an enterprise sales or outside sales motion gives reps the opportunity to get an inside look into the buyer’s operations, build relationships, and deliver a clear business case.

Multithreading is essential for bringing decision-makers together to navigate budget conversations and get them to make a purchasing decision.

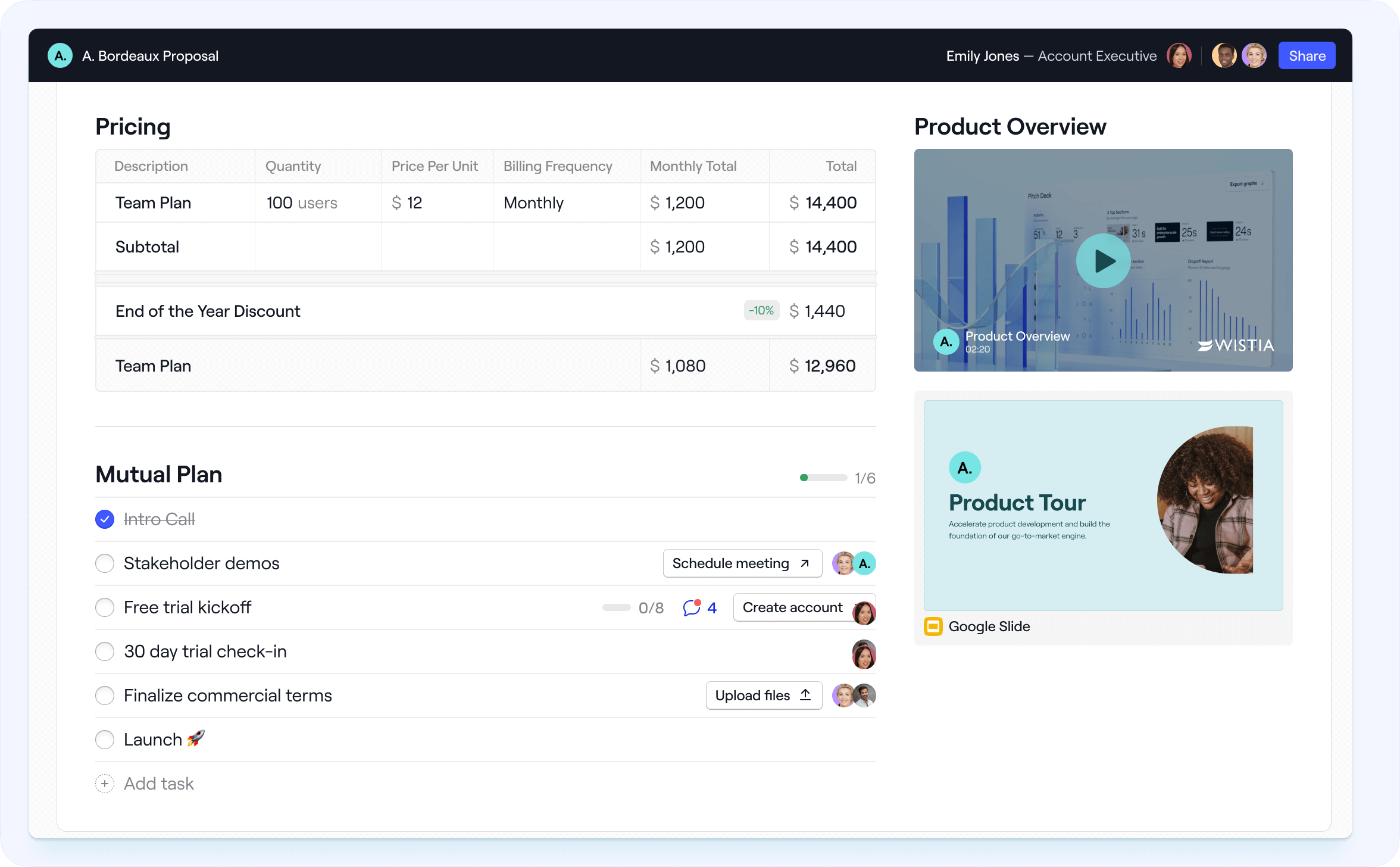

After finding a champion, how do you make sure they’re relaying the right info to their team? By using a Dock digital sales room.

Instead of sending a slew of emails and attachments, reps can give the buyer all of the information they need to make a decision in one place.

Thanks to Dock’s workspace analytics, you also get the benefit of seeing which other stakeholders are involved in the process, which helps track buying activity and intent throughout the long sales process.

2. Budget and resources

How much time and money will your product cost to deploy?

Land and expand is easy to set up. A few BDRs and AEs can prospect into the right accounts and start searching for upsell or cross-sell opportunities. They don’t even have to be product experts.

With a good product pricing and packaging strategy and CSM/AM support, you can start generating expansion pipeline quickly.

On the other hand, product-led sales requires expertise, technology, and time.

In Figma’s example, it took a village. They needed representation from virtually every revenue team to map out the user journey and decide how to process leads.

On top of that, they purchased product-led sales software to find intent signals within accounts and surface them to reps. The sales team had to be fluent in the product to be able to close deals and gain trust.

3. Market size and reach

If you have a wide total addressable market (TAM), product-led sales makes more sense.

You want users to self-serve and find a use case on their own. Once they’re able to see the value, then the product-led sales team can convert them into buyers or enterprise accounts through targeted outreach.

In these scenarios, you want to be able to close deals quickly.

Instead of using rigid document templates and bulky CPQ systems to put together quotes for customers, Dock can help you build pricing quotes in seconds.

If your universe of customers is small, every deal is high-stakes.

Sales teams need to convert at a much higher rate to hit quota, which means it’s important to deliver a white-glove experience.

If you’re working with a short target account list, outbound sales, outside sales, and channel sales motions are the best fit.

With outbound and/or outside sales, AEs take an account-based approach to deeply understand the prospect’s business and pinpoint use cases. Then, they find a way into the room (physically or virtually) by advising customers on how to improve their internal processes, with your product at the center.

It’s consultative selling.

The channel sales motion works well for a different reason. Channel partners can help you reach customers you can’t. Some software buyers are located in different parts of the world or prefer to buy through consultants or resellers. In fact, a 2021 TrustRadius Report found that 70% of buyers preferred to buy through a reseller or managed service provider (MSP).

In that sense, channel partners can help reach potential buyers who would never have heard about you otherwise.

4. Complexity of your product and its functionality

The nature of your product can also dictate the sales motion.

Complex products require implementation support. That’s where channel sales shines. Partners can introduce your product as a part of a wider solution, take a hands-on approach during rollout, and handle customizations. This gives customers the confidence they need to sign the contract.

For example, some of the channel partnerships we had at Chili Piper would attach our product to a Salesforce or Hubspot implementation. Since they were certified consultants, customers trusted their recommendations.

Enterprise sales teams are similarly equipped to handle complex products. Through consultative selling, they find ways to ingrain the product into a company’s process and handle the needed change management to drive adoption.

On the other hand, a user-friendly solution lends itself to a product-led sales or land-and-expand motion. Buyers can find value themselves through a pilot or small purchase, and then become champions for larger deals.

5. Ideal customer profile

If you’re selling to an enterprise CTO, your salespeople will need a way to get their foot in the door. That means building relationships through outside sales, or going bottoms-up. Sending a cold LinkedIn DM probably won’t get their response.

Through product-led sales, reps can earn the CTO’s attention by sharing how employees are already generating ROI with your solution.

But decision-makers don’t have time to comb through product dashboards and spreadsheets. They expect a red-carpet experience.

With Dock’s product-led sales template, you can convince senior leadership and IT to upgrade by showing them the benefits (instead of telling or selling them).

Conclusion: Most sales motions overlap

The reality is that most sales motions overlap, and your buyer doesn’t care what sales motion you use as long as it works for them.

In that sense, sales motions are like arrows in a quiver. Pulling the right ones is how you hit the target. Peter Prowitt, Head of Revenue at Stytch, calls it picking “the right tool for the right job.”

No matter which motions you deploy, removing the friction across the entire buying journey–from initial evaluation to renewal–is the key to accelerating sales cycles and decreasing time to value.

Dock helps you upgrade the buying experience from demo to onboarding. Sign up now, it’s free!

.jpg)